PropNex Picks

|October 09,2025Could Singapore End Up Like Hong Kong?

Share this article:

Hong Kong has a reputation for having some of the world's most expensive housing, despite the fact that many homes are shockingly small.

Whether or not you've noticed, homes in Singapore are getting smaller too, and this "shrinkflation" has been in action since 2010. Yet, prices continue to climb. And while Singapore may not have reached the extremity of Hong Kong's infamous cage or coffin homes, the trend here is starting to feel similar.

So the question is, could Singapore end up like Hong Kong?

It's no secret, Hong Kong has been experiencing a housing crisis for a while now. In fact, housing prices there went up sixfold (from the lowest to the highest point), and they continued to go up consistently. So it's not a surprise that demand for public rental flats went up as well, making wait times much longer. As a result, those from lower-income households are forced to stay in subdivided homes, tiny units carved out of older apartments. Today, over 220,000 people live in these cage or coffin homes.

Source: The Guardian

Hong Kong's position as a global financial hub, combined with its limited usable land area, has historically led to tension between supply and demand. And despite government efforts to cool the market and expand supply, affordability continued to worsen, at least until recently.

After years of an upward trend, Hong Kong's property market finally entered a downturn. Property values dropped significantly. Just last year, residential property prices experienced double-digit declines. And a big reason for that is the mismatch of supply and demand.

That's right. The city that is practically known for its limited housing supply is now facing the opposite. New completions and shrinking demand have pushed vacancy rates to record highs. Developers are even offering discounts to clear up their stocks.

It doesn't help that Hong Kong's currency is pegged to the USD, meaning interest rates have to go up together with the Federal Reserve. Higher interest rates = steeper mortgage. And if this isn't enough to deter investors (especially high-net-worth foreign individuals), Hong Kong's political unrest and stricter national security laws are. In fact, the number of multimillionaires has dropped since 2023, possibly due to these economic factors and political uncertainty.

And this has not only driven away investor confidence, but also many Western businesses like dining group Castelo Concepts and Outback Steakhouse, which have closed nine eateries each. This means retail and office vacancies remain high with little sign of recovery.

At the same time, emigration has accelerated while inflows have slowed, which further erodes housing demand.

At first glance, the parallels are scary. Much like Hong Kong, Singapore is a small island with limited land and a heavy reliance on real estate as both an investment vehicle and a pillar of the economy. And it's true that homes are getting smaller despite the increasing prices, both in the public and private sectors.

HDB flats:

- Flats today are up to 20% smaller than those built in the 80s

- Executive flats, once the largest standard offering, have been discontinued since August 1995

- 4-room flats (the most common choice for families) have shrunk by about 15% over the decades

Private condominiums:

- Modern 3-bedroom units are now the size of older 2-bedroom units

- 4-bedroom units have shrunk by 30% over the years, making them less common in new property developments, compared to smaller units

- 5-bedroom units are not found in every project, with sizes much smaller than in the 90s

Singapore is not building cage homes any time soon. For starters, there is a strict law here to limit the number of occupants in a single premise, regardless of whether it's public or private housing. And, unlike Hong Kong, where subdivided housing reflects deep structural inequalities and the failure to provide affordable alternatives, the shrinkage of homes in Singapore is the result of deliberate choices such as:

- Government regulations designed to optimise the limited land supply

- Developer strategies that keep overall unit prices within reach

- Shifting buyer preferences shaped by lifestyle changes and shrinking household sizes

In other words, while homes here may be compact, they are not a symptom of a systemic housing failure.

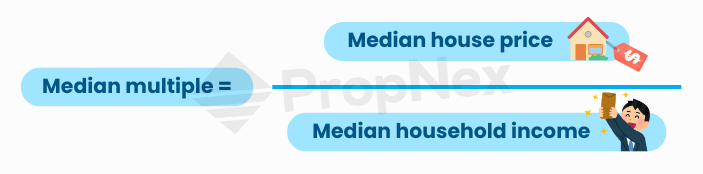

To show you just how stark the contrast is between the two nations, let's look at affordability. Using a median price-to-income ratio or "median multiple" (median house price divided by median household income), Demographia is able to rank housing affordability in different nations.

According to their 2025 international housing affordability report, Hong Kong has consistently ranked as the least affordable housing market for 14 years running, with median home prices once reaching more than 20 times the median household income. Even with recent improvements, it still sits at 14.4, far beyond the reach of ordinary families. In comparison, Singapore comes in at 4.2 for HDB resale flats.

Rating | Median Multiple |

Affordable | 3.0 & Under |

Moderately Unaffordable | 3.1 to 4.0 |

Seriously Unaffordable | 4.1 to 5.0 |

Severely Unaffordable | 5.1 & 8.9 |

Impossibly Unaffordable | 9.0 & Over |

And although that number is still considered "seriously unaffordable" by Demographia's standards, the lived reality is quite different. In fact, around 90% of Singaporeans own their homes, which is a far cry from Hong Kong's coffin cubicles.

While we do share some surface similarities with Hong Kong, there's not much to worry about. Singapore's housing system is built on safeguards that Hong Kong never had. The government actively controls supply through Government Land Sales (GLS) and HDB, which still houses over 80% of Singaporeans. They also step in with cooling measures whenever speculation threatens stability. Plus, we have a relatively stable political environment, so investors (especially foreign investors) can see that our property market has strong long-term fundamentals.

Of course, that doesn't mean flats here will suddenly get bigger or cheaper, but it does mean we're far less likely to see the extreme swings, imbalance supply, or political risks that destabilised Hong Kong. As long as policies continue to evolve and homeownership remains relatively affordable, Singapore is unlikely to walk down the same troubled path.

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position. No part of this content may be reproduced, distributed, transmitted, displayed, published, or broadcast in any form or by any means without the prior written consent of PropNex.

For permission to use, reproduce, or distribute any content, please contact the Corporate Communications department. PropNex reserves the right to modify or update this disclaimer at any time without prior notice.